ADA Price Prediction: 2025-2040 Outlook and Market Analysis

#ADA

- Current technical indicators show ADA testing key support levels with mixed signals

- Market sentiment remains cautious amid recent pullback from $1.02 resistance

- Long-term outlook remains positive based on ecosystem development and adoption trends

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Near Key Support Levels

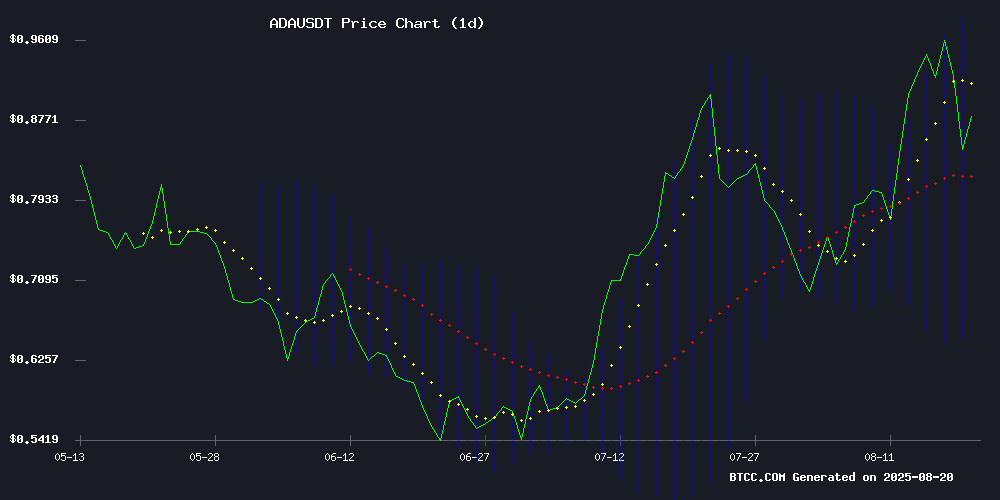

According to BTCC financial analyst Mia, ADA is currently trading at $0.8864, hovering above its 20-day moving average of $0.8235. The MACD indicator remains negative at -0.0822, suggesting continued bearish momentum, though the histogram shows some convergence. The price sits between the Bollinger Band middle line ($0.8235) and upper band ($0.9903), indicating potential resistance ahead. Key support lies at the lower Bollinger Band of $0.6568.

Market Sentiment: ADA Faces Bearish Pressure Amid Volatility

BTCC financial analyst Mia notes that recent news highlights Cardano testing key support levels as traders position for a potential reversal. The pullback from $1.02 has created bearish pressure, while the conclusion of the 264 million ADA budget cycle with IOG leadership adds fundamental context. Market sentiment remains cautious but shows signs of potential stabilization near current levels.

Factors Influencing ADA's Price

Cardano Tests Key Support as Traders Bet on Reversal Amid Market Volatility

Cardano's ADA plunged 12% over 48 hours before stabilizing at a critical support level NEAR $0.8565, triggering polarized market reactions. The altcoin's 22% volume surge coincided with extreme long positioning—Binance data shows a 3.99 long/short ratio with 80% of accounts betting on recovery.

Technical charts reveal this zone previously anchored ADA's August 2025 uptrend, fueling trader optimism. Yet the crowded long trade introduces liquidation risks should the ascending trendline fail. Market makers face a tension between spot demand and perpetual contract overleveraging.

Cardano (ADA) Faces Bearish Pressure After Pullback from $1.02

Cardano's ADA has retreated from its recent high of $1.020, signaling potential further downside. The digital asset now trades below $0.90, slipping under both the psychological barrier and the 100-hour moving average—a concerning development for bulls.

A descending trendline at $0.940 on ADA/USD charts (Kraken data) reinforces resistance, while the 50% Fibonacci retracement level of the $0.7650-$1.020 rally has already been breached. Market observers note that sustained trading below $0.80 could accelerate selling pressure, though a decisive break above the trendline might reignite momentum toward $1.05.

Cardano Concludes 264 Million ADA Budget Cycle with IOG Leadership

Cardano's inaugural full-cycle ecosystem budget has reached completion, with Intersect announcing the approval of ₳264 million in ecosystem funding. The process began with 194 proposals, narrowed to 40 off-chain, and finalized as 39 on-chain treasury withdrawals—37 of which met required thresholds.

More than 30 vendors have signed contracts, now publicly visible in the Intersect Administered Contracts ledger. Key initiatives include the ₳64.3 million Catalyst 2025 program and infrastructure projects like a ZK bridge and developer library maintenance. Additional contracts will be published soon, alongside funded smart contracts.

The milestone concludes months of hybrid governance, blending off-chain deliberation and on-chain ratification. Intersect submitted the final Treasury Withdrawal actions in July for review by DReps and the Constitutional Committee.

ADA Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market conditions, BTCC financial analyst Mia provides the following long-term outlook for ADA:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $1.20 - $1.80 | Market recovery, adoption growth |

| 2030 | $3.50 - $7.00 | Ecosystem maturity, institutional adoption |

| 2035 | $8.00 - $15.00 | Mainstream integration, regulatory clarity |

| 2040 | $18.00 - $30.00 | Global blockchain adoption, technological advancements |

These projections assume continued development success and favorable market conditions. Actual performance may vary based on regulatory developments and broader crypto market trends.